Unsere besten Spreads und Konditionen

Mehr erfahren

Mehr erfahren

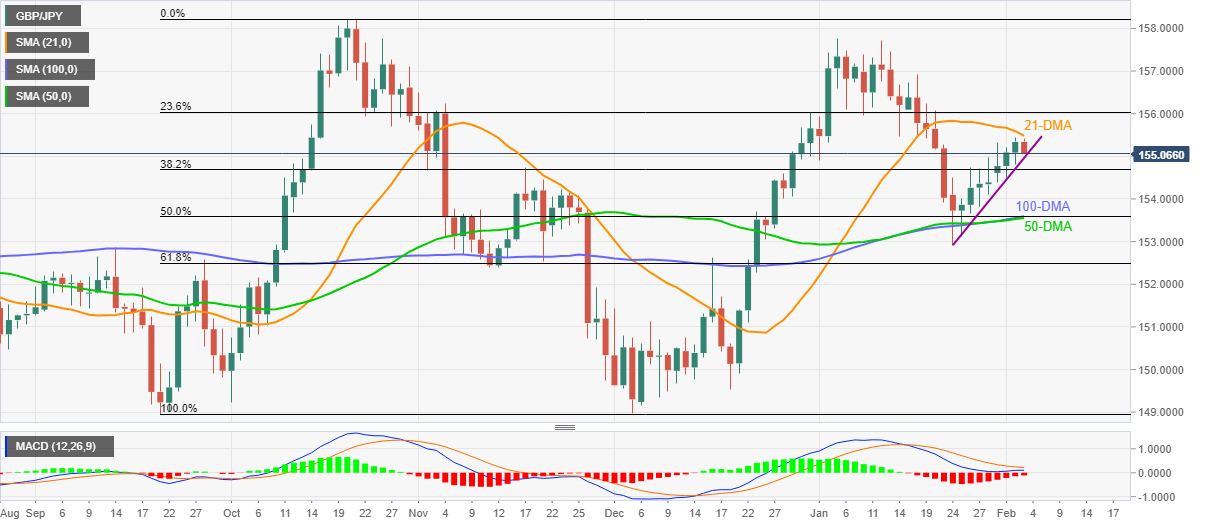

GBP/JPY takes offers to refresh intraday low near 155.10, printing the first daily loss in eight ahead of the Bank of England (BOE) monetary policy meeting.

In doing so, the cross-currency pair portrays a U-turn from the 21-DMA level of 155.50, attacking a one-week-old ascending trend line, near 154.90.

It should be noted, however, that the receding bearish bias of MACD and sustained trading beyond the short-term support line favor buyers.

That said, fresh buying will wait for a clear upside break of the 155.50 level before directing GBP/JPY prices towards 23.6% Fibonacci retracement (Fibo.) of September-October 2021 upside, near 156.00. Following that, the January 2022 peak of 157.75 will be in focus.

Meanwhile, a downside break of the stated support line near 154.90 will direct GBP/JPY towards 38.2% Fibo. level surrounding 154.70.

However, a convergence of the 100-DMA, 50-DMA and 50% Fibonacci retracement level around 153.55-60 become a tough nut to crack for the bears.

Trend: Bullish