Back

17 Mar 2020

Crude Oil Futures: Decline could take a breather

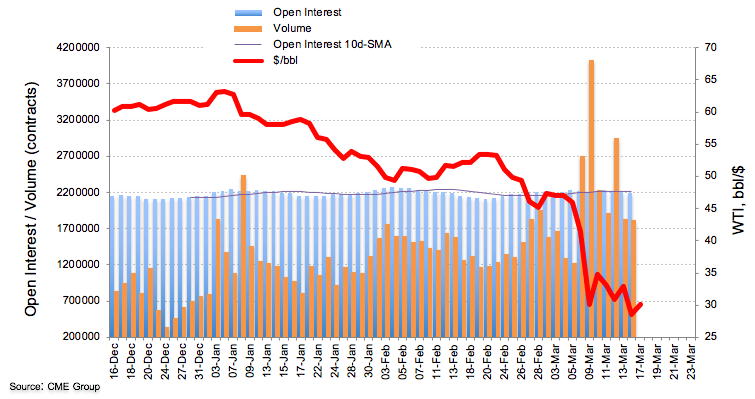

Open interest in crude oil futures markets shrunk by nearly 9K contracts on Monday, reaching the third consecutive drop according to flash data from CME Group. Volume, too, went down for the second straight session, this time by more than 12K contracts.

WTI looks supported below $28.00/bbl

Prices of the WTI stay under pressure although some decent support seems to have emerged in sub-$28.00 per barrel for the time being. Diminishing open interest and volume coupled with negative price action on Monday open the door to a potential rebound in the short-term. This view is also reinforced by the extremely oversold condition of the commodity, as per the daily RSI.