Back

16 Mar 2020

Crude Oil Futures: Look neutral/bearish near-term

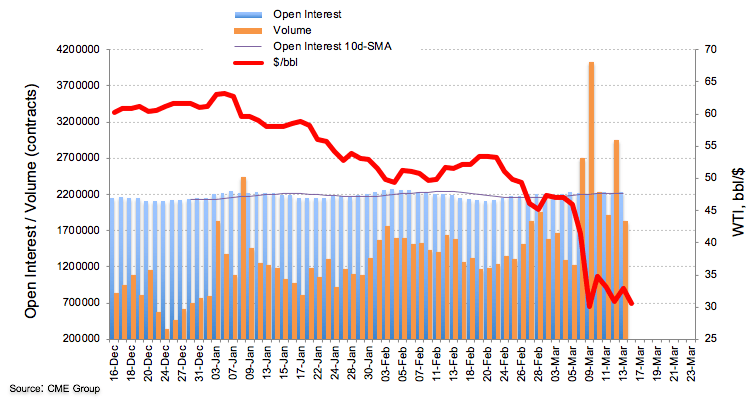

Open interest in crude oil futures markets rose by around 7.7K contracts at the end of last week, extending the choppy performance according to advanced prints from CME Group. On the other hand, volume seems to have resumed the downtrend and shrunk by around 1.110M contracts, offsetting the previous build.

WTI does not rule out a re-test of 2020 lows

The positive performance of prices of the barrel of WTI on Friday was accompanied by riding open interest, which could add to the idea that the rebound could extend further. However, the important drop in volume removes tailwinds from this view and could favour another visit to the YTD low at $27.29 (March 9th).