Back

16 Mar 2020

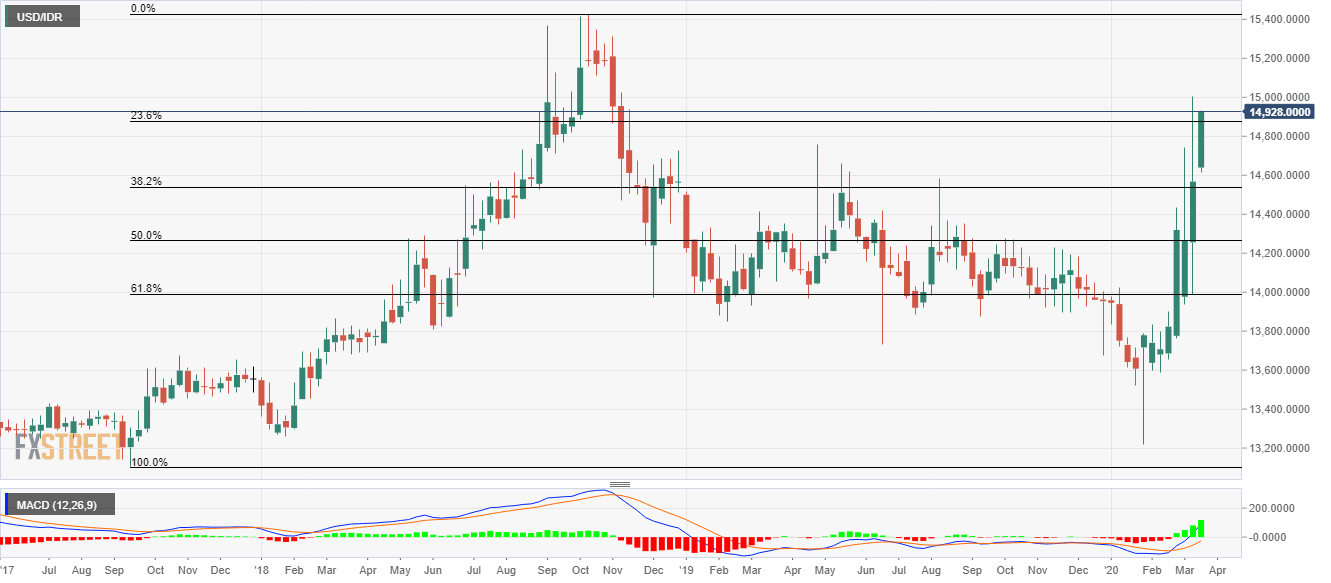

USD/IDR Price Analysis: Pierces 23.6% Fibonacci, on its way up to 15,000

- USD/IDR remains on the front foot.

- Break of 23.6% Fibonacci retracement, bullish MACD keep the upside momentum intact.

- Sellers will look for entry below 38.2% Fibonacci retracement.

USD/IDR takes the bids to 14,930 by the press time of early Monday. In doing so, the pair clears 23.6% Fibonacci retracement of its rise from September 2017 to October 2018.

As a result, traders will now keep eyes on 15,000 round-figure as an immediate resistance ahead of challenging the late-October 2018 low near 15,110.

In a case where the bulls remain dominant past-15,110, the year 2018 high near 15,430 will be in the spotlight.

On the downside, 38.2% Fibonacci retracement near 14,535 acts as immediate support.

During the pair’s additional weakness past-14,535, multiple supports around 14,350 and 50% Fibonacci retracement level of 14,260 could please the sellers.

USD/IDR weekly chart

Trend: Bullish