EUR/USD clinches 1.0820 on upbeat PMIs

- EUR/USD pushes higher to the 1.0820 region, session highs.

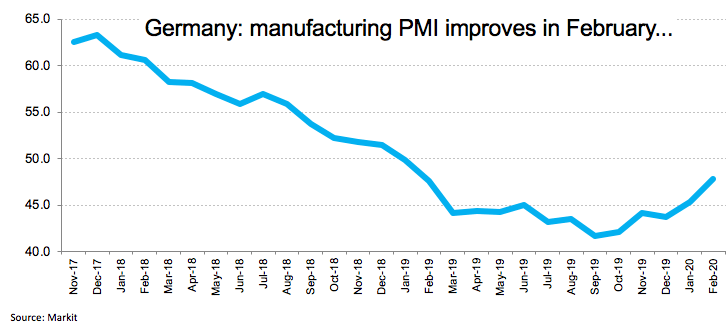

- Flash manufacturing PMIs in Germany, EMU lift the mood around euro.

- USD-selling also favours the better tone in the pair.

The single currency is now trading on a better mood and is lifting EUR/USD to fresh daily highs in the 1.00820 zone at the end of the week.

EUR/USD up on better-than-expected data

EUR/USD appears to have stabilized in the lower end of the yearly range around the 1.0800 neighbourhood, always amidst the ongoing alternating risk appetite trends and generalized strength in the buck.

In fact, concerns around the Chinese coronavirus (COVID-19) remain far from abated and are expected to keep swinging the mood in the global markets via its impact on economic growth prospects.

The greenback, in the meantime, is seeing some profit taking on Friday and allowing some recovery in the risk-associated universe at the same time. The dollar, however, looks well supported by solid results in US fundamentals as of late, coronavirus fears and the steady Fed.

The euro met extra buying interest on Friday after German and EMU advanced manufacturing PMIs are seen improving to 47.8 and 49.1, respectively, during February, bettering consensus. Further data in the region showed Italian Industrial New Orders expanded at a monthly 1.4% in December while Industrial Sales contracted 3.0% MoM in the same period.

Across the pond, advanced PMIs, Existing Home Sales and another round of Fed-speakers should keep the interest on the buck later in the NA session.

What to look for around EUR

EUR/USD is seen some light at the end of the tunnel this week on the back of upbeat data in the euro docket, managing at the same time to put further sistance from recent YTD lows in the 1.0780/75 band. As usual, USD-dynamics are expected to keep ruling the pair’s price action for the time being along with the broader risk appetite trends, where the COVID-19 remains in centre stage. On another front, the ECB is expected to finish its “strategic review” (announced at its January meeting) by year-end, leaving speculations of any change in the monetary policy before that time pretty flat. Further out, latest results from the German and EMU dockets continue to support the view that any attempt of recovery in the region remains elusive for the time being and is expected to keep weighing on the currency.

EUR/USD levels to watch

At the moment, the pair is gaining 0.31% at 1.0817 and faces the next resistance at 1.0879 (2019 low Oct.1) seconded by 1.0892 (23.6% Fibo of the 2020 drop) and finally 1.0981 (monthly low Nov.29 2019). On the downside, a breach of 1.0777 (weekly/2020 low Feb.20) would target 1.0710 (monthly low Jan.5 2016) en route to 1.0569 (monthly low Apr.10 2017).